Va irrrl closing costs calculator

Low Fixed Mortgage Refinance Rates Updated Daily. Closing costs are typically 2 to 4 of the loan amount.

Va Loan Funding Fee Closing Cost Calculator

For example if youre buying at 150000 you can offer 155000 with the.

. About one-third of all VA loan borrowers are exempt so ask a VA loan lender if you qualify for an exemption. Also called IRRRL they can be used to lower interest rates by refinancing existing VA loans. The Best Lenders All In 1 Place.

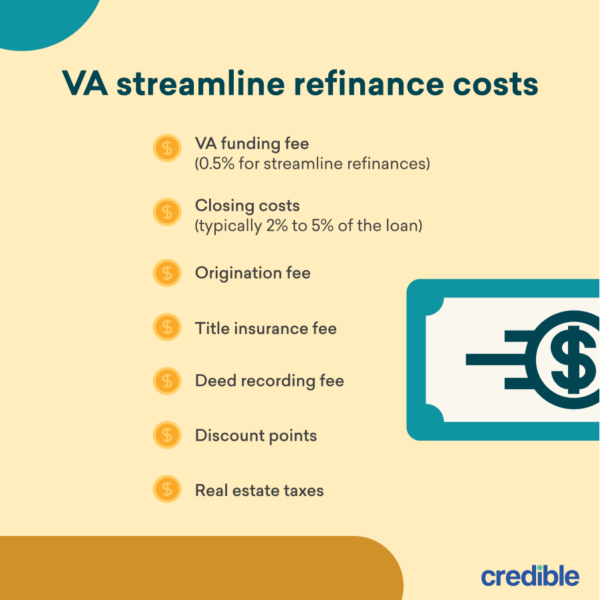

Most veterans and service members will have to pay a one-time VA funding fee when they get a VA loan. Discount Points Mortgage discount points are available with. Typically closing costs range.

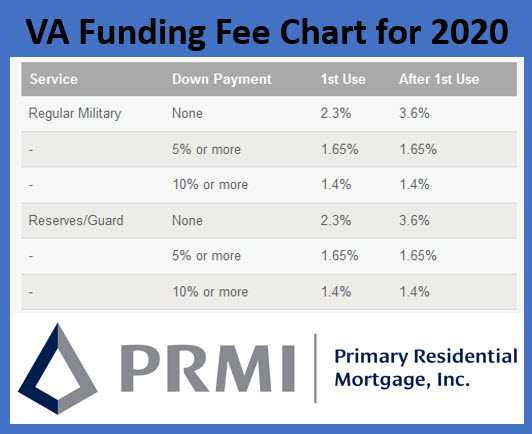

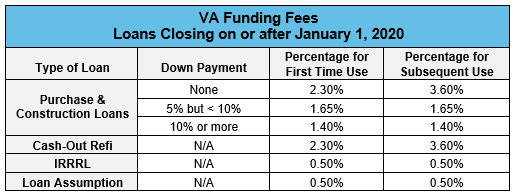

Follow your lenders process for closing on the IRRRL loan and pay your closing costs. As of January 1 2020 the VA funding. Are You Eligible For The VA Loan.

The closing costs of VA refinances are often between 1 and 3 of the loan amount. You should expect to pay 425 875 for a VA appraisal fee which will be included in the closing costs. Apply Get Pre Approved.

How much does the VA Funding Fee Cost. The closing costs of VA refinances are often between 1 and 3 of the loan amount. You may need to pay the VA funding fee.

Ad Let Americas 1 Online Lender Help You Use Your VA Benefits. Ad Let Americas 1 Online Lender Help You Use Your VA Benefits. Special Pricing Just a Click Away - Get Started Now See For Yourself.

Ad Compare VA IRRRL Closing Costs For 2022. Lender origination fees rate discount points title and recording fees the VA appraisal and more. What Closing Costs Can Be Added to a VA IRRRL.

Beyond the VA Funding Fee closing costs might include. This one-time fee helps to lower the cost of. When you are buying a house this funding fee currently ranges between 14 and.

No SNN Needed to Check Rates. The VA lenders handbook says that in regards to IRRRLs closing costs can include the VA funding fee unless you are exempt. But you cant just roll them on top of your final loan amount other than the VA Funding Fee if that makes sense.

They vary depending on the value of the home loan terms and property location and include costs such as mortgage insurance. Start By Checking The Requirements. Since the monthly PI for recoupment purposes of the new IRRRL is 85106 this loan would not meet the recoupment requirement.

That means for a 300000 mortgage VA closing costs could be anywhere from 3000 to 15000. For example if the costs and fees to close on an IRRRL come out to 4000 and the new loan saves the homeowner 125 per month the time to recoup those upfront expenses would be 32. First calculate how much your loan balance is going up from closing costs.

Ad Todays Best VA IRRRL Rates Curated for Your Needs. If however the lender uses the current rate. Ad Find Out If You Qualify For a Low Rate in Minutes.

It is also possible to refinance adjustable-rate mortgages ARM into fixed-rate mortgages. The costs can include the funding fee lender fees discount points and payments for taxes and insurance. According to the Consumer Financial Protection Bureau CFPB the average VA loan.

Va Funding Fee Calculator Deals 53 Off Www Velocityusa Com

Irrrl Closing Costs Irrrl Com

How Much Will My Va Appraisal Cost Irrrl

Va Mortgage Calculator Calculate Va Loan Payments

Va Loan Closing Costs Complete List Of Fees To Expect

Va Irrrl Va Interest Rate Reduction Refinancing Loans

Va Irrrl Refinance

Va Loan Funding Fee Closing Cost Calculator

Va Streamline Refinance Va Irrrl How It Works And When To Get One Credible

Delaware Va Loans For Veterans Prmi Delaware

Va Loan Funding Fee What You Ll Pay In 2022 Nerdwallet

Va Streamline Refinance Irrrl 100 Cash Out Interest Rate Reduction

Va Funding Fee Calculator Deals 53 Off Www Velocityusa Com

Va Funding Fee Calculator Purchase Sale 45 Off Aarav Co

Va Loan Calculator Estimates Your Mortgage Payment Casaplorer

Va Loan Calculator Estimate Your Monthly Mortgage Payment And Va Funding Fee The Military Wallet

What Are The Irrrl Allowable Fees Irrrl